Financial Resources for Living at Autumn Trace of Columbia City

About Our Rent

When considering a senior living community, it often seems more affordable to older adults and their families to continue managing life in their current home because the mortgage is either paid off or is lower in cost compared to the monthly fee to live at Autumn Trace. The fact of the matter is the comparison is not apples-to-apples.

There are a variety of costs that go into the overall management of a home such as property taxes, insurance, utilities, and food. There are other expenses that may not be monthly such as deferred maintenance of the major systems and structures of the home, repair and replacement of appliances, and other costs associated with the upkeep and maintenance of a home inside and out.

After fully assessing the cost of senior living against the cost of living at home, the gap is considerably less–if there is a gap at all.

What is not addressed in the cost comparison is the quality of life, independence, and peace of mind that is not a matter of dollars and cents:

- 24/7 access to staff

- All meals prepared

- ADA compliant environment

- Entertainment, socialization, and companionship

- Security

- Transportation to medical appointments and shopping

- Ability to access services for assistance with daily living, such as medication reminders, when needed

- Ability for family to work or go on vacation without worry

Financial Options

Veteran’s Aid and Attendance Benefit

If you are a wartime veteran, or the surviving spouse of a veteran paying for assisted living services, you may be eligible for a tax-free pension from the US Department of Veterans Affairs, which provides up to the follow amount per month through the Aid & Attendance benefit.

Surviving spouse: $1318

Single Veteran: $2050

Married Veteran spouse needs care: $1610

Married Veteran when Veteran needs care: $2431

Veterans Financial, Inc. will help you navigate the eligibility and application process free of charge. To learn more, please contact 1-800-835-1541, or visit www.veteransfinancial.com

Life Insurance Assets and Long-Term Care Insurance

Long term care insurance can help defray the costs of senior living. Additionally, many individuals are unaware that their life insurance policy is a financial asset that can be sold to fund their current senior living expenses. Commonly referred to as a Life Settlement, it involves the sale of an existing life insurance policy to an investor for a lump sum cash settlement greater than the cash surrender value given by the insurance company.

Cash settlements typically range in amounts between 10% and 40% of the life insurance policy’s face value. Policy owners may want to consider this option if they have outlived the purpose of a life insurance policy, can no longer afford it, feel it has become an under performing asset, or require liquidity and are considering letting the policy lapse.

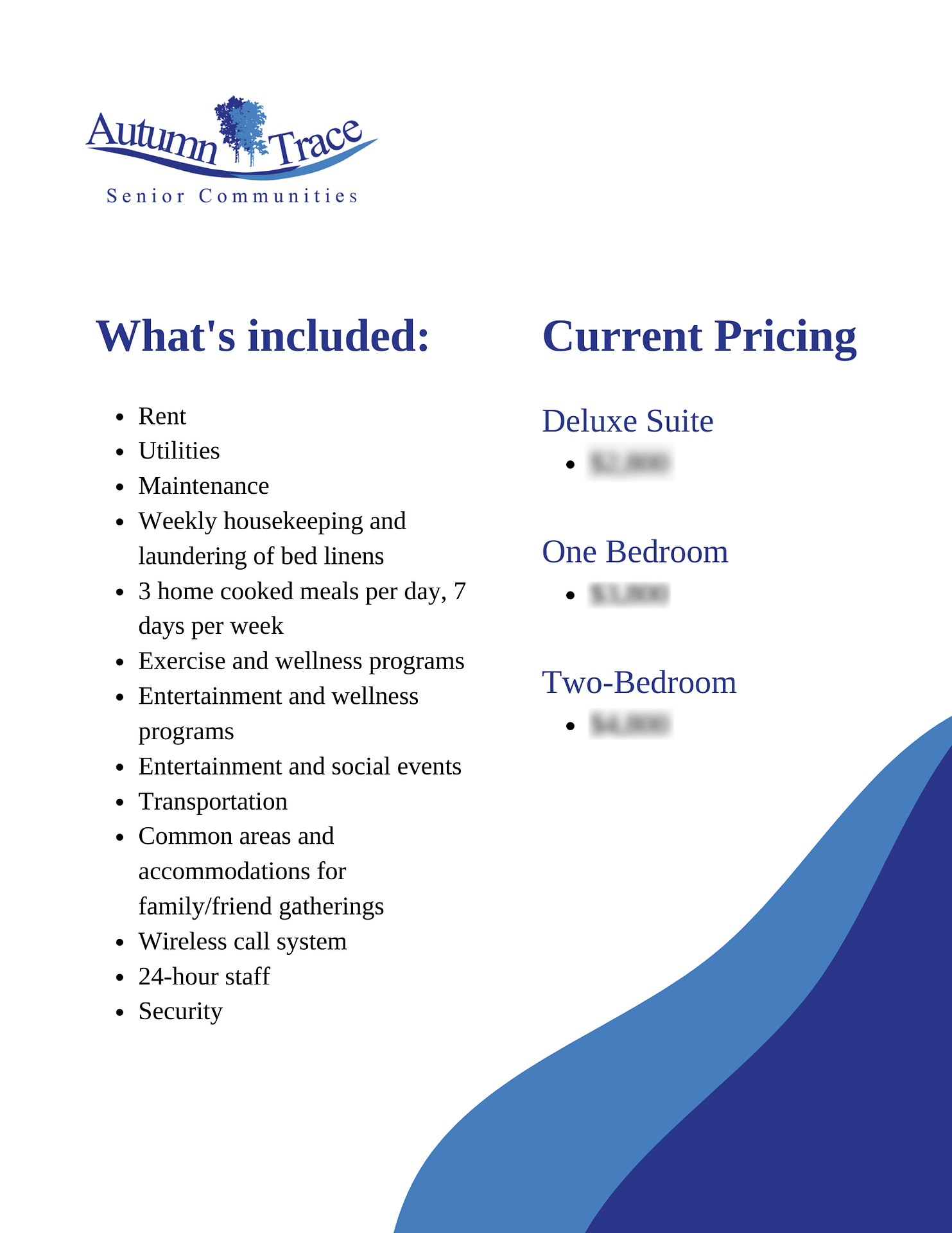

Download our current pricing!

Autumn Trace Senior Communities is transparent about pricing and will never ask for an expensive buy-in. We have included in the monthly fee all the worry-free amenities you expect and offer additional services ala carte, so you only pay for the extra services you need. See our current apartment suite leasing options and prices.